Easy steps of Sales and Service Tax SST registration Malaysia. Benefits of setting up a LLC in Malaysia.

Difference Between Gst And Sst Ask Any Difference

The single-stage tax imposed only on the output stage.

. The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018. Pricing The price of a product or service is inclusive of GST. Sales and Service Tax SST in Malaysia.

It works as an add-on besides the selling price Rates 6. Comparison Chart- GST VS SST. SST not included in the price.

SST vs GST Differentiating tax policies in Malaysia. In Malaysia corporations are subject to corporate income tax real property gains tax goods and services tax GST and etc taxes. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come.

Top reasons to make a business investment in Malaysia. A type of multi-stage and value-added tax. In other words resident and non-resident organisations doing business and generating taxable income in Malaysia will be taxed on income accrued in or derived from Malaysia.

Ways of overcoming the crisis. Business opportunities during Covid pandemic in Malaysia.

Welcome Back Sst So What S New Propsocial

Gst Vs Sst Which Is Better Pressreader

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions

Getting To Know The Difference Between Sst And Gst

Gst Malaysia Info Difference Between Gst And Sst Facebook

Differences Between Gst And Sst Nashcxt

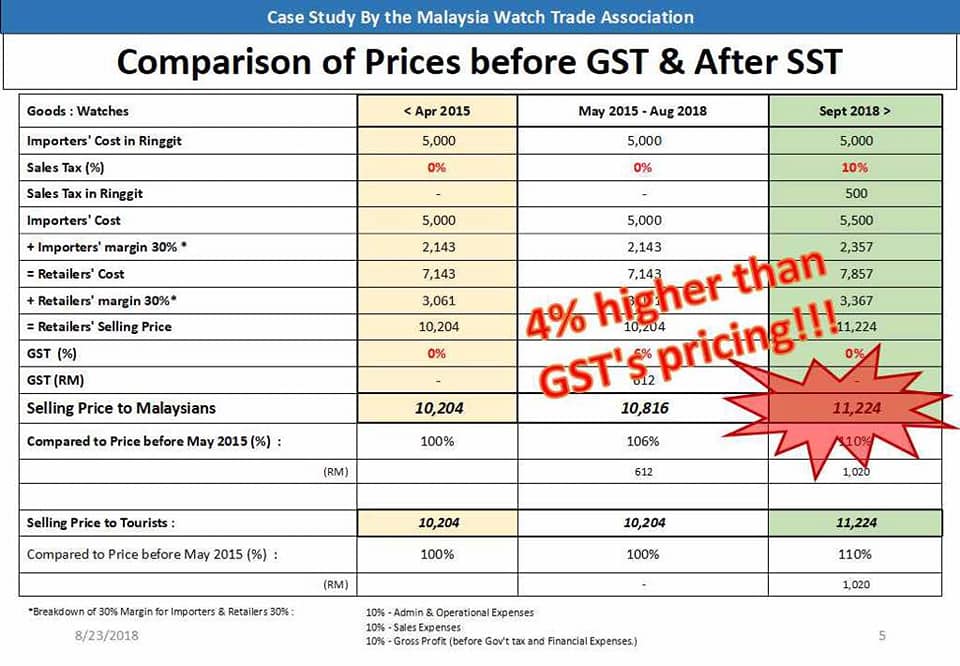

Comparison Of Prices Before Gst After Sst Mwta Malaysia Watch Trade Association

A Guide To Gst In Malaysia How Does It Affect Me

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Compare Between Gst And Sst Savannagwf

Difference Between Sst And Gst

Difference Between Sst And Gst

- resipi biskut jintan susu

- sambal goreng hati ayam jtt

- kad kahwin 6 x 8

- lukisan bunga bakung

- undefined

- gst vs sst malaysia

- malaysia stock market news

- kursi jati gereja

- perkembangan idea ketupat

- lowongan medco power

- kata bijak untuk guru yang sombong

- mimpi kucing hidup kembali

- rupa organik dan geometri

- rhb easy loan table

- surat minta maaf ke orang tua

- ucapan selamat malam buat pacar yang lagi ngambek

- jenis ruang pameran

- kata kata cinta karena nafsu

- sepahtu reunion 2019 free

- cara hias pulut kuning simple